ETF vs. Mutual fund is the super confusing investment options in stock market now days. Basically these both ways are common to invest money. But, they both work differently like; their costs, how they are managed as well as how easily you can buy or sell them.

If you are going to decide between ETF vs. mutual fund, then this article will helpful for you. In this article we are going to discuss their key differences, tax implications and suitability as well as pros and cons for the investors. So, at the end of the article you will know which one is perfectly best option for your financial goals.

What is Etf vs Mutual Fund?

So, here we are going to discuss the basic key features of these both with an example.

Exchange-Traded Funds (ETFs)

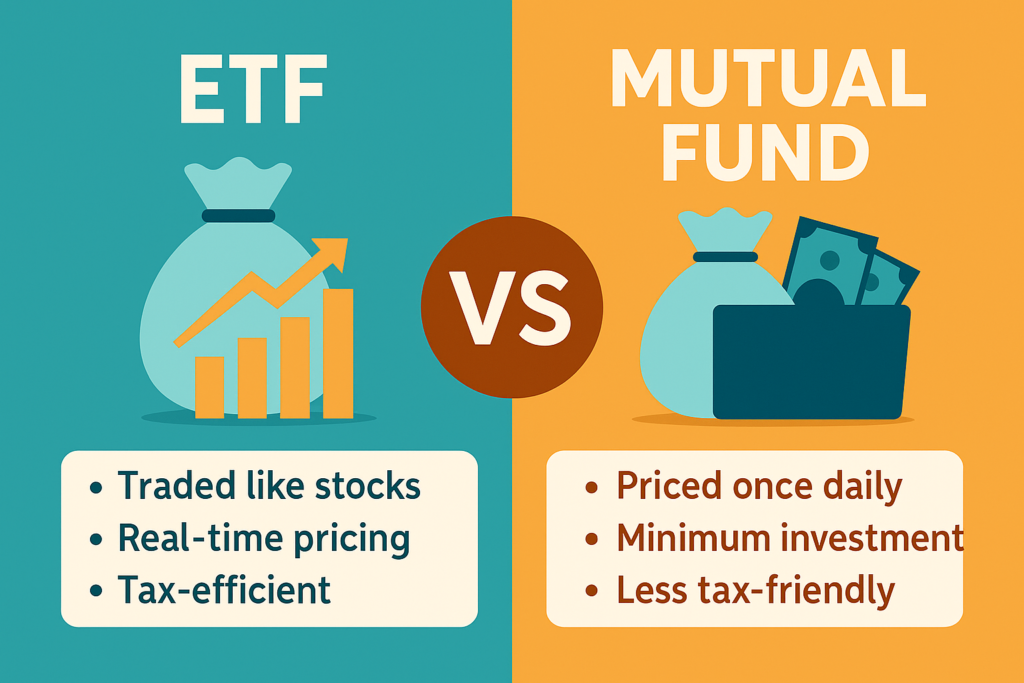

Exchange-Traded Funds are basically known as ETFs. These are portfolio of securities in stocks, commodities as well as bonds that can trade on stock exchanges like individual stocks. They usually follow a specific index, type of asset or sector and their prices can change throughout the trading days.

Basic Key Features of ETFs:

- Basically, ETFs have lower expense ratios rather then most mutual funds.

- It can traded like stocks buy/sold intraday at the market prices.

- They are tax-efficient because of a special process that is called in-kind creation and redemption, which helps reduce taxable events.

- It can offer clear transparency by showing their holdings every day.

Here is an examples of it: SPDR S&P 500 ETF (SPY), Vanguard Total Stock Market ETF (VTI), Invesco QQQ (QQQ).

Mutual Funds

Mutual Funds basically collect money from to many investors and use it to invest in a mix of stocks, bonds as well as other assets. Their price is a set just once in a day, closes the market and this is called; the Net Asset Value (NAV).

Basic Key Features of Mutual Funds:

- Mutual funds are managed in both ways actively as well as passively. In actively managed; manager picks investment while in passively managed index funds that follow the market.

- It have higher fees, especially in the actively managed ones.

- While, some funds have minimum investment limits as like sometimes it starting at Rs.1000 or more.

- Mutual funds are usually less tax-friendly as compare, because they may distribute capital gains to the investors.

Here is an examples of it: Vanguard Total Stock Market Index Fund (VTSAX), Fidelity 500 Index Fund (FXAIX).

Mutual Funds vs. ETFs: Key Differences

Here, we will describe the key differences including features of these both Mutual Funds vs. ETFs with the help of table. SO, that you can easily compare these.

| Feature | ETFs | Mutual Funds |

|---|---|---|

| Trading | Traded on exchanges (intraday) | Bought/sold at NAV (end of day) |

| Expense Ratios | Generally lower | Higher (especially active funds) |

| Tax Efficiency | More tax-efficient | Less tax-efficient |

| Minimum Investment | No minimum (price of 1 share) | Often $1,000+ |

| Management Style | Mostly passive (some active) | Passive or active |

| Transparency | Daily holdings disclosure | Quarterly disclosures |

| Dividend Reinvestment | Manual or automatic (broker-dependent) | Automatic |

Advantages and Disadvantages of Mutual Funds vs. ETFs

After knowing the key features and key differences now its time to know every advantages and disadvantages of both Etf vs. Mutual Fund.

Advantages of ETFs

- Lower fees – In the terms of lower fees, ETFs usually cost less to manage than mutual funds.

- Tax-friendly – ETFs create fewer taxable events as compare and helping you save on taxes you have to paid.

- Trade anytime – While in the term of trade, you can buy or sell ETFs any time the stock market is open.

- No big investment needed – One of the biggest advantage of ETFs is, you can start with just one share.

Disadvantages of ETFs

- Trading fees – In the case of trading fees some brokers may charge a fee to buy or sell, while many offer free ETFs trading as of now.

- Price gaps – Price gaps shows the difference between buying and selling prices (bid-ask spread) can affect what you pay, especially for ETFs that don’t trade often.

- No auto-invest – You have to buy and sell ETFs yourself; there is no automatic investment option like with mutual funds.

Advantages of Mutual Funds

Easy automatic investing – One of the popular advantage of mutual fund is you can set up regular and automatic investments.

Expert management – Expert management also beneficial like fund managers actively try to grow your money by beating the market.

Simple pricing – You can buy and sell at the same daily price (NAV), with no price gaps in mutual funds.

Disadvantages of Mutual Funds

Higher costs – Management fees can reduce your profits over the time and that is one of the disadvantage of the mutual funds.

Less tax-friendly – in that case, you might owe taxes from capital gains the fund distributes.

Investment minimums – In mutual funds there is nothing like you can start with one share, Some funds need a big amount to get started.

Which is Better for You? ETFs vs. Mutual Funds?

While, its all up to you that, which is suitable option for you ETFs Mutual funds. But still there are some basic key points that can helps you to compare and choose out of these two. According to that you can decide which features you want and which is better option for you.

| Choose ETFs If You… | Choose Mutual Funds If You… |

|---|---|

| Want lower costs and better tax efficiency | Prefer automatic investing (like SIPs or dollar-cost averaging) |

| Like the ability to trade anytime during market hours | Want expert fund managers to handle investments |

| Don’t want to meet a minimum investment amount | Are investing through employer retirement plans (e.g., 401(k)) |

| Prefer managing investments yourself through a brokerage account | Are comfortable with once-a-day pricing and long-term investing |

Tax Efficiency: ETFs vs. Mutual Funds

ETFs are generally more tax-friendly just because:

- They use a special method which is called in-kind redemption, which can helps avoid taxable capital gains.

- While, Mutual funds on the other hand, often have to pass on capital gains to the investors each year, which can lead to tax bills.

Best choice for taxable accounts: ETFs (they cause fewer tax issues).

Best choice for tax-advantaged accounts (like IRAs or 401(k)s): Both ETFs and mutual funds work well, since taxes are deferred.

Conclusion

So, Both ETFs as well as mutual funds offer long term growth and potential to earn more. Choices is yours that what you wants out of ETF vs. Mutual Fund to choose as per your investing style including fees and all.

FAQs

Do ETFs pay dividends?

Yes, many ETFs distribute dividends, which can be reinvested automatically or manually.

Which has higher returns: Mutual funds vs. ETFs?

Index ETFs and index mutual funds perform similarly. Active mutual funds may outperform but often fail to beat the market after fees.

Can you lose money in ETFs?

Yes, ETFs fluctuate with the market. However, diversification reduces risk compared to individual stocks.

Can I convert mutual funds to ETFs?

Some brokers (like Vanguard) allow conversions without tax consequences. Check with your provider.